Blog

How can developing countries deliver effective public financial planning?

In many less developed countries, there is little problem identifying the need for public investment in programmes aimed at improving things such as infrastructure, health and education. The problem comes in delivering them.

An important factor in whether these kinds of programmes are successfully implemented is states’ ability to develop effective public financial planning. For example, the capability to manage, implement, and monitor the budget is strategically important in this respect because it allows for timely access to resources, and so more efficient provision of public goods and services.

![]() On the other hand, a lack of predictability of financial resources undermines the planning of public expenditure and makes it harder for public officials to plan for the provision of goods and services. This is particularly relevant in the pursuit of the Sustainable Development Goals by 2030, an ambitious enterprise requiring effective state institutions. Indeed, SDG 16 explicitly refers to building effective, inclusive and transparent institutions (Target 16.6).

On the other hand, a lack of predictability of financial resources undermines the planning of public expenditure and makes it harder for public officials to plan for the provision of goods and services. This is particularly relevant in the pursuit of the Sustainable Development Goals by 2030, an ambitious enterprise requiring effective state institutions. Indeed, SDG 16 explicitly refers to building effective, inclusive and transparent institutions (Target 16.6).

The importance of institutions

Our recent research, a joint effort with the Effective States and Inclusive Development Research Centre at the University of Manchester, published as WIDER Working Paper 13/2018, finds that delivering effective public financial planning depends also on the kind of political institutions that countries adopt.

Political systems that place stronger constraints on executive power are more likely to lead to budgetary systems that have a high degree of transparency and predictability. This is because, when subject to institutionalised checks and balances, a ruler has less discretion over public finance decisions than one who is not.

Why is this? One mechanism concerns the presence of independent institutional actors within the national government that can control and subject to limits the use of state resources, so demanding greater accountability with respect to budgetary planning and implementation. For example, in parliamentary systems, an effective parliament can institutionally oversee and audit the state budget. Another mechanism concerns the possibility that chief executives subject to formal limitations to their power may be more likely to promote an independent civil service and so maintain or innovate the state’s public finance infrastructure and its ability to design, implement and monitor the budget.

Measuring the effect

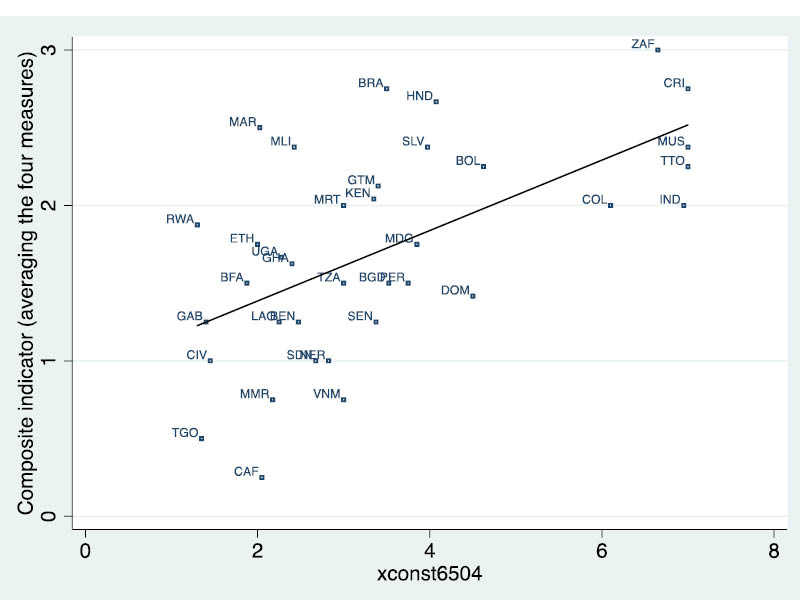

Based on a sample of 47 developing economies, our analysis looks at whether greater constraints on the executive have a positive impact on the degree of effectiveness of the financial planning authorities. We use a popular measure of the strength of checks and balances on the executive power by Polity IV. We also use a recently created set of indicators by the Public Expenditure and Financial Accountability project to capture the quality of the budgetary systems. We selected variables evaluating the capability to produce accurate domestic revenue forecasts in the preparation of the budget, the capability to implement the budget, and the quality of the debt management system.

Figure 1 shows that the extent of constraints on the executive power is positively correlated with variables that capture the quality of budgetary systems. Using a variety of regression methods and specifications to check the robustness of our results, we indeed conclude that the existence of effective constraints on the executive generally improves public financial planning, along all such dimensions.

How big is the effect? It is always challenging to make practical sense of regression estimates measuring the quality of institutions. Our results indicate that a typical increase in the constraints on the executive index has resulted in an average improvement of public financial planning of about half standard deviation over just under a decade. This suggests that, on balance, the impact also has economic (as well as statistical) significance.

Effective public financial planning crucial for the SDGs

Effective public financial planning crucial for the SDGs

An important route to developing effective public financial planning is strengthening political institutions providing effective checks and balances on the discretionary power of the executive. Designing and implementing reforms in this direction presents challenges, such as the opposition of groups that stand to lose from political change, and may only bring benefits in the medium-to-long term because the transmission mechanisms may be such that the effects are gradual. But it is worth trying. As set out in SDG 17, effective public financial planning will be crucial to mobilize resources to finance progress on other SDGs targets.

The views expressed in this piece are those of the author(s), and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

Author affiliations

Antonio Savoia, Global Development Institute, and Effective States and Inclusive Development (ESID) Research Centre, University of Manchester

Roberto Ricciuti, University of Verona and CESifo

Kunal Sen, UNU-WIDER, and Global Development Institute, University of Manchester

Join the network

Join the network