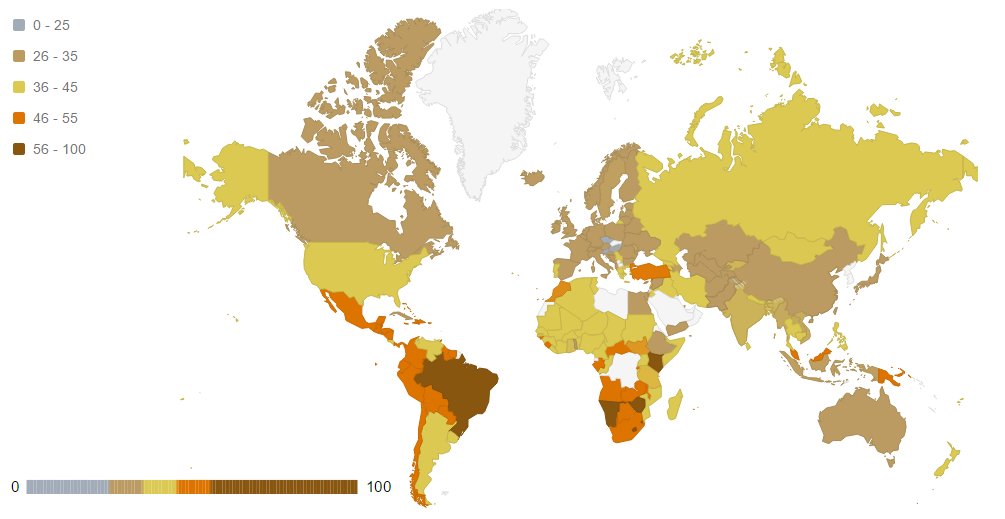

WIID – World Income Inequality Database

The WIID collects and stores information on income inequality for developed, developing, and transition countries. The database, its documentation, and the WIID Companion datasets are available on this website.

The WIID collects and stores information on income inequality for developed, developing, and transition countries. The database, its documentation, and the WIID Companion datasets are available on this website.

The latest version of the WIID, released 28 November 2023, includes inequality data on 201 countries (including historical entities) through 2022, with over 24,000 data points in total. There are now nearly 4,000 unique country-year observations in the WIID. The current version includes a WIID Companion, separate datasets that report standardized WIID data to create comparable country level inequality series, inequality indices, and country and global income distributions for the longest periods possible. The WIID Companion datasets are directly accessible in real time through our WIID Explorer, a powerful tool for accessing and analysing the most comprehensive collection of comparable income inequality statistics in the world. Read more

ETD – Economic Transformation Database

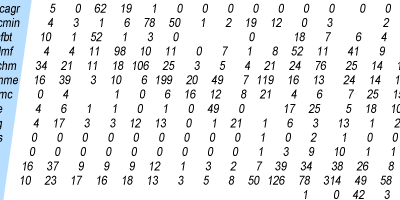

The GGDC/UNU-WIDER Economic Transformation Database (ETD) contains comprehensive, long-term, and internationally comparable sectoral data on employment and productivity from over 50 economies in Africa, Asia, and Latin America.

The GGDC/UNU-WIDER Economic Transformation Database (ETD) contains comprehensive, long-term, and internationally comparable sectoral data on employment and productivity from over 50 economies in Africa, Asia, and Latin America.

Launched in February 2021, the ETD provides open access to the most up-to-date and extensive information available on the structure of developing economies, and is a unique resource for empirical analysis of economic development. Read more

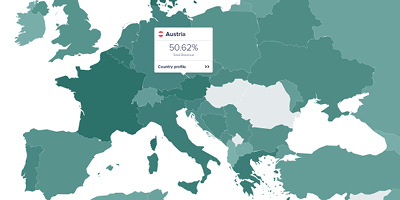

GRD – Government Revenue Dataset

The Government Revenue Dataset (GRD) includes data on government revenue, tax, and its subcomponents for 197 countries. It presents a complete picture of trends over time at the country, regional, and cross-country levels. The GRD is updated annually, with the most recent version released in August 2022 (with minor updates made in Oct 2022). The dataset, associated documentation, and the GRD Explorer visualisation tool are all available on this website. Read more

The Government Revenue Dataset (GRD) includes data on government revenue, tax, and its subcomponents for 197 countries. It presents a complete picture of trends over time at the country, regional, and cross-country levels. The GRD is updated annually, with the most recent version released in August 2022 (with minor updates made in Oct 2022). The dataset, associated documentation, and the GRD Explorer visualisation tool are all available on this website. Read more

SOUTHMOD – Simulating tax and benefit policies for development

While microsimulation models are routinely used by researchers and policy makers in developed countries, few developing countries have access to such tools. Many of the developing countries are now building up their social protection systems and the financing of public spending will need to be increasingly based on domestic tax revenues. This project aims to make tax-benefit microsimulation models available to developing countries. Read more

While microsimulation models are routinely used by researchers and policy makers in developed countries, few developing countries have access to such tools. Many of the developing countries are now building up their social protection systems and the financing of public spending will need to be increasingly based on domestic tax revenues. This project aims to make tax-benefit microsimulation models available to developing countries. Read more

SAM – Social Accounting Matrices

A SAM is a consistent data framework that captures the information contained in the national income and product accounts and a supply-use table (SUT), as well as the monetary flows between institutions. Since is an ex-post accounting framework, within its square matrix, total receipts must equal total payments for each account reported by the SAM. The required data is drawn from various sources and must, therefore, be compiled and made consistent. This process is valuable since it helps identify inconsistencies among statistical sources. For example, there are invariably differences between the incomes and expenditures reported in national household surveys and national accounts. SAMs are economy-wide databases which are used in conjunction with analytical techniques to strengthen the evidence underlying policy decisions. UNU-WIDER provides Social Accounting Matrices for South Africa and Mozambique. Read more

A SAM is a consistent data framework that captures the information contained in the national income and product accounts and a supply-use table (SUT), as well as the monetary flows between institutions. Since is an ex-post accounting framework, within its square matrix, total receipts must equal total payments for each account reported by the SAM. The required data is drawn from various sources and must, therefore, be compiled and made consistent. This process is valuable since it helps identify inconsistencies among statistical sources. For example, there are invariably differences between the incomes and expenditures reported in national household surveys and national accounts. SAMs are economy-wide databases which are used in conjunction with analytical techniques to strengthen the evidence underlying policy decisions. UNU-WIDER provides Social Accounting Matrices for South Africa and Mozambique. Read more

Mozambican manufacturing firms database

The Mozambican manufacturing firms database contains data on the characteristics of companies operating in the manufacturing sector of Mozambique. It includes company data on performance, history, employment, business environment, and owner and manager backgrounds, as well as economic accounts data.

The Mozambican manufacturing firms database contains data on the characteristics of companies operating in the manufacturing sector of Mozambique. It includes company data on performance, history, employment, business environment, and owner and manager backgrounds, as well as economic accounts data.

The latest version of the database, released in March 2020, tracks the economic development of over 700 companies across seven provinces in Mozambique between 2012 and 2017. Read more

Join the network

Join the network