Research Brief

The role of tax and benefit policies during the COVID-19 pandemic in Ecuador

What was the impact on earnings of the economic crisis caused by the first wave of the COVID-19 pandemic in Ecuador? To what extent did social assistance programmes compensate household income losses? ECUAMOD, the tax-benefit microsimulation model for Ecuador, helps to assess the distributional impact of the pandemic in the country.

Poverty and inequality increased dramatically in Ecuador between December 2019 and June 2020 as a result of the COVID-19 pandemic

The poverty rate, measured with the national poverty line, rose from 25.7% to 58.2% over this period and extreme poverty increased from 9.2% to 38.6%

Inequality measured by the Gini coefficient increased substantially from 0.461 to 0.592

On average, household disposable income dropped by 41%

The new Family Protection Grant provides income protection for the poorest income decile. However, overall tax-benefit policies had only a limited effect in mitigating the losses in household incomes due to the pandemic

In response to the COVID-19 outbreak, governments worldwide have implemented a variety of policies aimed at mitigating the adverse effect of the economic shock on household income. However, unlike most developed economies, countries in Latin America lack the fiscal capacity to implement large income protection programmes. Moreover, some countries in the region were already facing challenging economic conditions because of low commodity prices prior to the pandemic. This was the case for Ecuador, which has been hit hard by the health crisis and faces difficulties in strengthening social protection for its citizens.

In this analysis, ECUAMOD is used to assess the immediate distributional impact of the COVID-19 pandemic and the role of government policy interventions in mitigating the socioeconomic effects of the crisis in Ecuador.

The analysis covers the changes in the income distribution between December 2019 and June 2020, the period when the economy was the most affected by the pandemic. ECUAMOD simulations allow to quantify the effects of: (i)  earnings losses due to COVID-19, (ii) automatic stabilizers, that is automatic changes in tax-benefit policies due to the shock (for instance decreases in tax payments as a result of decrease in earnings), and (iii) the new COVID-related Family Protection Grant introduced by the government to protect low-income families against the economic shock.

earnings losses due to COVID-19, (ii) automatic stabilizers, that is automatic changes in tax-benefit policies due to the shock (for instance decreases in tax payments as a result of decrease in earnings), and (iii) the new COVID-related Family Protection Grant introduced by the government to protect low-income families against the economic shock.

Changes in disposable income

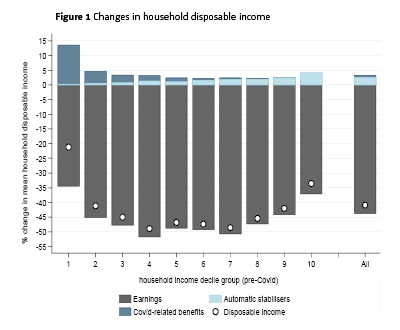

The results of the simulations (Figure 1) show that, on average for the whole population (All), household disposable income (white circle) drops sharply by 41% as a result of the COVID-19 pandemic. The fall in household disposable income reflects the losses in earnings (dark grey bar) resulting from the crisis, which account for a 43.8% reduction in disposable income, on average. The analysis further shows that, on average, the mitigating role of automatic stabilizers (light blue bar) and COVID-related policies (dark blue bar) is extremely modest, with a larger contribution of automatic stabilizers (light blue bar) compared to that of COVID-related policies. Automatic stabilizers contribute to a 2.5% increase in average disposable income for the whole population, whereas COVID-related policies account only for a 0.8% increase.

Source: authors’ elaboration using ECUAMOD v1.5 and ENEMDU 2019 (INEC 2019).

A U-shaped pattern in the change of mean household disposable income is observed across the income distribution, reflecting that households in the middle of the income distribution experience larger drops in earnings compared to those at the bottom and top. The effect of automatic stabilizers and COVID-related policies also varies across the income distribution. The contribution of automatic stabilizers, in particular social insurance contributions and personal income tax, increases with income and they mitigate the effect of the economic shock mostly through their effect in the top decile, where they account for 4.1% of household disposable income. Benefits fail to provide stabilization to the poorest deciles, as they do not react automatically to income losses (e.g., proxy means-tested benefits).

The COVID-19 emergency Family Protection Grant plays an important role in mitigating the impact of the crisis for households at the bottom of the distribution. For the first income decile group, a 34.5% drop in household disposable income due to earning losses is alleviated by a 13.4% increase as a result of the COVID-related benefit.

Impact on income poverty and inequality

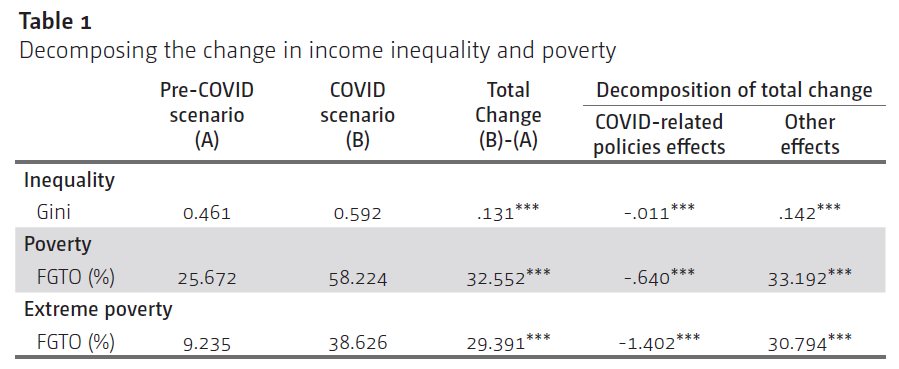

The analysis shows a dramatic increase in income poverty and inequality in Ecuador between December 2019 and June 2020 (Table 1). Inequality measured by the Gini coefficient increases from 0.461 to 0.592. The poverty rate (FGT0), measured with the national poverty line, goes up from 25.7% to 58.2% and the extreme poverty rate increases from 9.2% to 38.6%.

Source: authors’ elaboration using ECUAMOD v1.5 and ENEMDU 2019 (INEC 2019)

This analysis shows that the new COVID-related Family Protection Grant plays a minor role in mitigating the effect of earnings losses on poverty and inequality.

Rethinking social protection

There is a need to rethink and enhance social protection in Ecuador and the region

Countries in the region should consider the possibility of designing benefits acting as automatic stabilizers, which will automatically buffer the adverse effects in the event of large economic crises

Redesigning social protection should go hand in hand with efforts to build fiscal capacity in order to ensure the sustainability of social policies in the long term

Fiscal reforms should, however, not be restricted to personal income tax and VAT. Reforms to corporate and wealth taxes should also be considered

These results indicate the need to rethink and enhance social protection in Ecuador and the region. Countries in the region should consider the possibility of designing benefits acting as automatic stabilizers in the event of large economic crises, as existing social assistance relies mostly on benefits which do not react automatically to losses in household income (e.g., proxy means-tested benefits).

Redesigning social protection should go hand in hand with efforts to build fiscal capacity in order to ensure the sustainability of social policies in the long term. Fiscal reforms should, however, not be restricted to personal income tax or value added tax (VAT). Reforms to corporate and wealth taxes should also be considered as tools to build fiscal capacity and fight against poverty and inequality.

This brief, also available in Spanish (Disponible en español), is based on the WIDER Working Paper 4/2021 'The role of automatic stabilizers and emergency tax–benefit policies during the COVID-19 pandemic in Ecuador', by H. Xavier Jara, Lourdes Montesdeoca and Iva Tasseva. The study has been prepared within the SOUTHMOD - simulating tax and benefit policies for development project.

Join the network

Join the network