Blog

Fintech and domestic savings

A perfect match coming true in sub-Saharan Africa

Financial technology (FinTech) is a major force disrupting the structure of financial services in sub-Saharan Africa (SSA) and enabling access of unbanked people to financial services. This will likely have a deep, positive impact on the volume of savings in African countries. In this blog, I explain the current status of FinTech and its potential on the continent.

A vital component of financial inclusion is savings. As mentioned by Charles Ackah and Monica Lambon-Quayefio in their blog, countries with high domestic savings rates tend to experience higher economic growth rates. Sub-Saharan Africa lags behind the global average and East Asia and the Pacific in gross savings as a percentage of GDP. Even though the region does well compared to Latin America and the Caribbean, a large informal sector and a sizeable share of the population remaining unbanked are major stumbling blocks for financial inclusion and boosted rates of domestic savings.

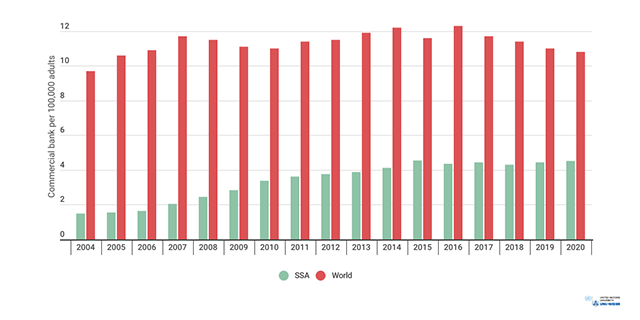

As a result of the low competition in the banking industry, SSA consumers pay relatively high prices for financial services. This deters many from opening bank accounts. According to the World Bank’s Global Findex Database 2021, mainstream financial institutions in SSA cater to only 40% of the adult population compared to the global average of 74%. In 2020, the number of commercial banks per 100,000 adults in sub-Saharan Africa was 4.52, half of the global average of 10.8. This illustrates the need for SSA countries to tap into the vast pool of financial resources outside mainstream financial institutes to boost domestic savings and investment (Figure 1).

Figure 1: Commercial bank branches (per 100,000 adults) in SSA and the world

FinTech innovations as financial enablers

FinTech affects the financial market structure by incorporating new technologies that reduce the costs of financial services. It also enables the large population of sub-Saharan Africans who are unbanked to access financial services.

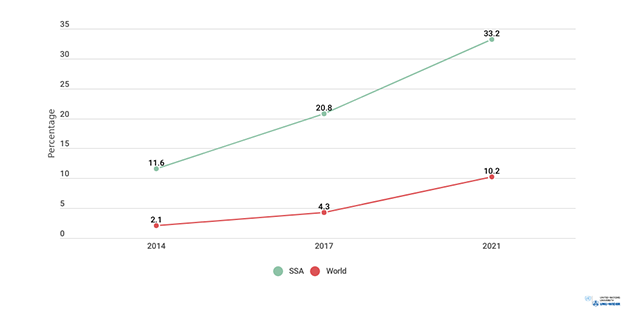

SSA is already a global leader in mobile money transfer services (see Figures 2 and 3). With new FinTech products constantly being developed and adopted in sub-Saharan Africa, the domestic savings landscape is changing.

Figure 2: People who own a financial institution account (% age 15+)

Figure 3: People who own a mobile money account (% age 15+)

Countries in the region show the way

Several factors have contributed to the success of mobile money platforms in sub-Saharan Africa. The region’s low number of financial institution branches, automatic teller machines (ATMs), and the dearth of internet connections make it difficult to transfer remittances or pay bills. Also, a large informal sector holds considerable financial resources that are not deposited in savings accounts or passed through other formal financial channels. This creates a sizeable unfulfilled demand for financial services.

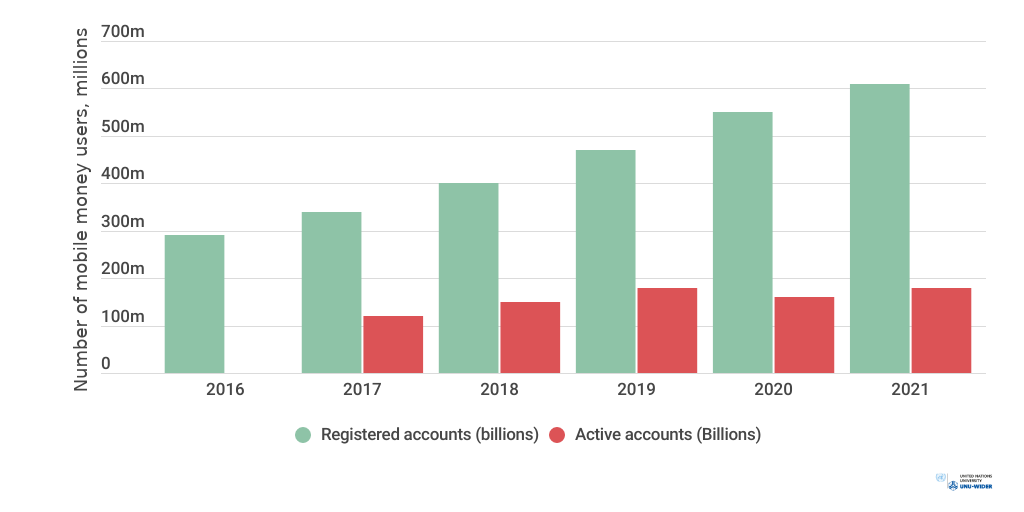

By now, the region has more mobile money agents than bank branches and ATM outlets (Figure 4). The successful penetration of mobile phones in SSA provides a technological platform that mobile money agents use to enhance financial transactions and savings. According to GSMA State of the Industry Reports on Mobile Money, the region also leads in the number of mobile money users, and in the volume and value of transactions.

Figure 4: Number of mobile money users in SSA

FinTech providers are able to leverage their experience, advanced technological platforms, extensive customer base, cost savings, and efficiency in logistics to extend financial services to their customers.

For example in Kenya, which is one of the global leaders in FinTech, the providers leverage on the extensive penetration of mobile devices and good network coverage to provide tools like Safaricom’s M-Shwari. Built on a sensible pricing strategy that attracts customers, a reliable network, and suitable regulation, the rise of the M-Shwari platform in Kenya is a successful case of mobile money platforms helping to enhance domestic savings rates.

The GSMA State of the Industry Report 2021 explains that most mobile money providers in SSA provide dedicated savings facilities directly or through partnerships with deposit-taking institutions. Growth in awareness of the significance and advantages of mobile money-enabled savings, as well as its capacity to foster a permanent and profound savings culture among low-income customers, is indicated by the strong rise in both the value of savings, the number of new accounts, and the volume of transactions.

Way forward

A well-functioning mobile money system is indispensable for financial inclusion and the promotion of domestic savings in sub-Saharan Africa. However, promoting savings and financial inclusion through mobile money goes beyond savings. The region has broad demand for many other underdeveloped financial services, such as mobile investment, insurance, and pension services.

Going forward, sub-Saharan African governments should promote mobile money to accelerate the inclusion of unbanked users in sub-Saharan Africa into the formal financial system by integrating mobile money with mainstream financial services.

In the case of Kenya, mobile network operators partnered with financial institutions to create a hybrid system that offers access to other formal savings products. In addition to M-Shwari, these include mobile pension schemes such as Mbao Pension Plan for informal sector workers. Bima Hima mobile motor vehicle and medical insurance plans are other mobile money products that may help to incentivize greater domestic savings and inclusive growth.

Josphat Machagua is a policy analyst specializing in FinTech, globalization, trade, global financial flows, debt, investment, innovation, and green energy. He has an M.A in Economics from The University of Nairobi.

The views expressed in this piece are those of the author(s), and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

Join the network

Join the network