Blog

A brief history of the role of energy in the global economy

The last 25 years

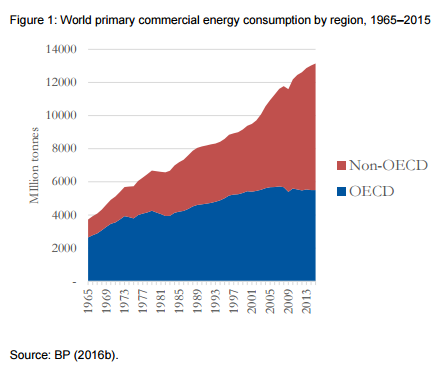

Ever since the British Industrial Revolution, energy has been a key factor of production. Recent history has proved no exception. The pattern of primary commercial energy consumption since 1965 is presented in Figure 1.

What is also clear is that, since the start of this century, energy consumption in non-OECD countries has grown strongly, while in OECD countries it peaked in 2004. This is because of the lagged relationship between prices and energy consumption following the oil shocks of the 1970s.

The effects of the oil price shocks of the 1970s were to push oil out of the static sector (power generation), where it was replaced initially by coal and gas. However, until recently, oil retained its favoured position in the transport sector, while gas remained a constrained fuel, limited by its high transportation costs.

Moreover, the use of gas in the power sector was proscribed by regulation in the US and the EU between 1975 and 1990. In emerging market economies, its domestic development by the (foreign) companies that had discovered the gas was also constrained in the face of non-convertible currencies. Thus, gas earned only revenue that the foreign company could not remit back to its shareholders

Oil and gas in global trade

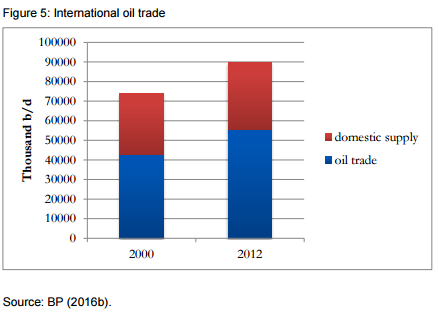

Oil and gas are major internationally traded commodities. Figure 5 shows the proportion of traded oil consumed and the way that this trade has been increasing this century. Because of economies of scale, transporting oil and oil products is extremely easy and extremely cheap. This goes a long way to explaining why oil is an internationally traded commodity with a unified market, while gas remains traded in regional markets.

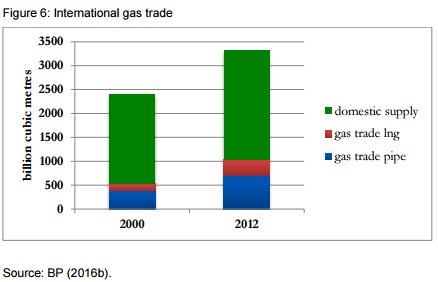

By contrast, gas suffers from what has become known as ‘the tyranny of distance’. As can be seen from Figure 6, a much smaller proportion of consumption is traded internationally, although this has been growing since 2000.

For many countries, the oil and gas trade makes a significant contribution to the current account in the balance of payments. In particular, a number of oil exporters are dependent upon oil exports for their foreign exchange.

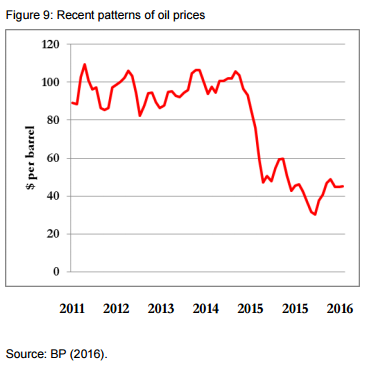

Prices and the macro economy

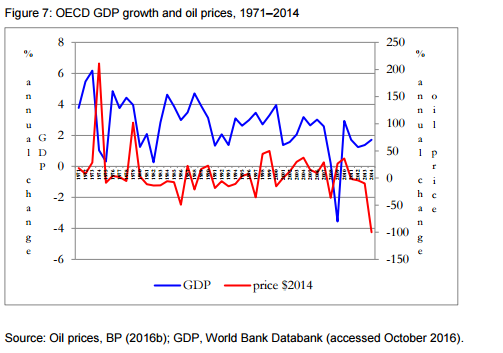

The higher prices seen in all natural resources from 2004 to 2014 have brought the issue of the ‘resource curse’ back into the policy debate. Linked to the debate on the resource curse has also been a revived interest in economic diversification in countries dependent upon oil and gas revenues. The key point here is that oil revenue is not income. Rather, it simply represents the re-shuffling of the nation’s portfolio of assets.

In the initial stage of oil production, it provides financial resources, which should be used to promote economic development. Production then reaches a plateau. In this transition phase, it is crucial that the financial resources released by producing the oil are used to create an alternative income producing asset. Eventually, production will decline as a result of natural depletion. For export earnings, this process is accelerated as domestic consumption rises. In this stage it is no longer feasible to rely on oil revenues to support the rest of the economy. Therefore, oil-dominated economies should aim from the very early stage of production to diversify away from dependence on oil revenues.

Geopolitics and their economic impact

Geopolitics and oil are inextricably linked. There are two oil markets: the wet barrel market, where real barrels of crude oil are bought and sold; and the paper barrel market, where promises (written on paper) to deliver or take delivery of oil are exchanged. Understanding the wet barrel market requires Economics 101. Understanding the paper barrel market requires Psychology 101. The relationship between the two markets is complex and controversial but comes down to issues of perception. Those negotiating contracts in the wet barrel market will look to the paper barrel market to get an indication of what prices might be. Those in the paper barrel market deciding where to invest will look to the wet barrel market for signs of surplus or shortage.

There are two problems here that aggravate oil price volatility. First, many of those playing in the paper markets do not really understand the oil industry and frequently misread the state of the wet barrel market, often assuming shortages when there are none. The second source of price volatility is that perceptions can change in the blink of an eye—and, with them, prices.

In my recent WIDER Working Paper ‘The role of oil and gas in the development of the global economy’ I build on the history presented above to consider various conventional views of the future of oil and gas in the primary energy mix, trying to explain why there is a tendency towards consensus in the different forecasts. I then seek to challenge these conventional views by examining the relative importance of the various drivers of the future—economic and technological and geopolitical and to show why the future may prove to be very different from what is expected and how this may change the context in which producers must frame their policy responses. Read the full paper here and keep an eye on UNU-WIDER’s Extractives for Development project.

The views expressed in this piece are those of the author(s), and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

Join the network

Join the network